EA has announced it plans to be acquired for 55 billion dollars by a consortium of investors led by Public Investment Fund of Saudi Arabia.

Under the terms of the deal announced today, the private equity firm Silver Lake Partners, Saudi Arabia’s sovereign wealth fund PIF and Affinity Partners will pay EA’s stockholders $210 per share. Affinity Partners is a private equity firm run by Donald Trump’s son-in-law, Jared Kushner.

Electronic Arts would be taken private.

The total value of the deal eclipses the $32bn price paid to take Texas utility TXU private in 2007.

If the transaction closes as anticipated, it will end EA’s 36-year history as a publicly traded company that began with its shares ending its first day of trading at a split-adjusted $0.52.

The IPO came seven years after EA was founded by former Apple employee William “Trip” Hawkins, who began playing analog versions of baseball and football made by Strat-O-Matic as a teenager during the 1960s.

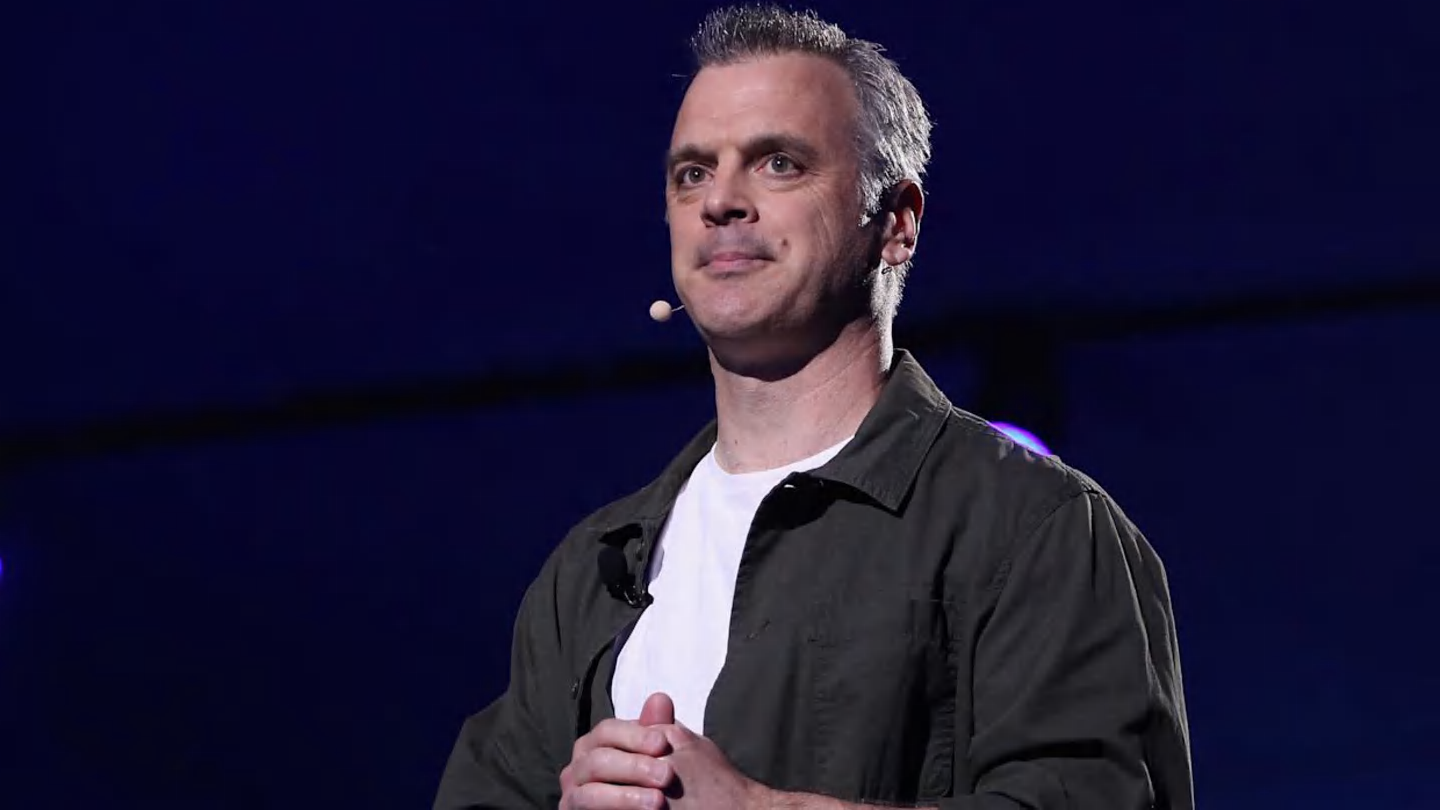

EA has been run by its current CEO, Andrew Wilson, since 2013.

This marks the second high-profile deal involving Silver Lake and a technology company with a legion of loyal fans in recent weeks. Silver Lake is also part of a newly formed joint venture spearheaded by Oracle involved in a deal to take over the US oversight of TikTok’s social video platform, although all the details of that complex transaction haven’t been divulged yet.

Silver Lake has also previously bought out two other well-known technology companies, the now-defunct video calling service Skype in a $1.9bn deal completed in 2009, and a $24.9bn buyout of personal computer maker Dell in 2013. After Dell restructured its operations as a private company, it returned to the stock market with publicly traded shares in 2018.

EA is known for making best-selling games such as EA FC, The Sims and Mass Effect.

www.bbc.com